BROWN COUNTY, WI (WTAQ-WLUK) — Brown County’s half percent sales tax isn’t going anywhere any time soon.

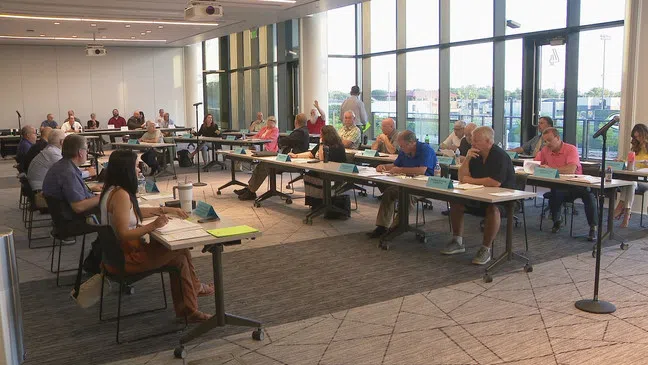

The county board voted Wednesday night to extend it until the county’s debt is eliminated, which is projected to be in 2037.

In the past four years, Brown County’s sales tax has helped pay for things like the new STEM building at UW-Green Bay, a new jail pod, and road repairs.

“Our taxes are coming down by sticking to this plan,” said supervisor Richard Schadewald. “This is what works. This is what has proven itself.”

Since taking effect at the beginning of 2018, county officials say the tax has helped lower the county’s debt from about $118 million dollars to about $58 million. The tax rate has also gone from 4.59% percent to 3.72%.

“When we would have bonded for those projects and incurred that interest, that would have impacted all the property taxpayers in Brown County,” said Brown County Executive Troy Streckenbach.

The tax was supposed to be done at the end of next year.

No one from the public spoke against the extension during the meeting. Only four of 26 board members voted against it.

“This is being rushed,” said supervisor Pat Evans. “We have another year to go.”

“The property tax relief is very far off like 10 to 14 years away, which is a political lifetime,” said supervisor Dave Landwher.

Now that the tax has been extended, county board members will have to decide which projects should be funded after 2023. County officials say there is a list of $747 million worth of projects waiting to be funded.

“I think it is no secret that the county has been very laser focused in on infrastructure projects, specifically the southern bridge,” said Streckenbach.

Decisions on what will be funded and when will likely start coming later this year.

The Brown County Taxpayers Association has voiced its opposition to the current sales tax and the extension.

It had an unsuccessful lawsuit to try to end the sales tax, and before the extension vote had said it might pursue another lawsuit.